Are you considering rolling over your current retirement savings plan to a traditional or Roth IRA this year? With the many benefits that IRAs have to offer, this may seem like a great idea.But, if not done properly, you could be subject to some costly penalties and fees, as well as face the possibility of having to pay taxes on the entire amount this year!

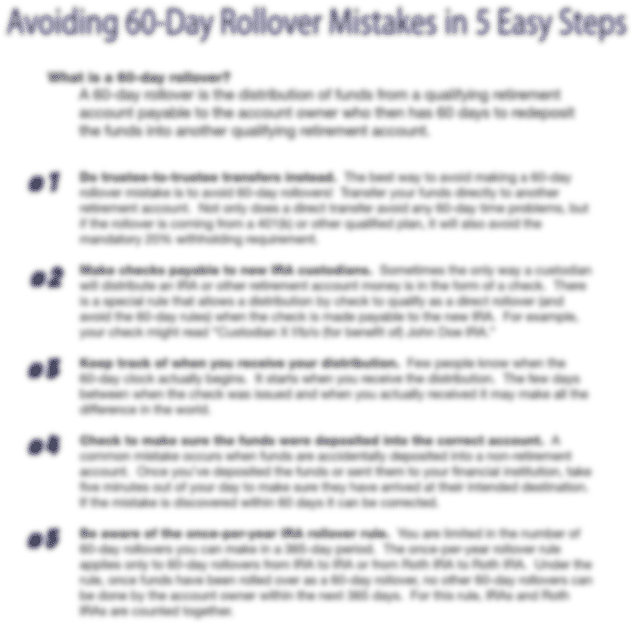

One way to rollover funds to an IRA is through a “60-day rollover,” which is the distribution of funds from a qualifying retirement account to the account owner, who then has 60 days to redeposit the funds into another qualifying retirement account. With this approach to rollovers there is room for a number of errors. Find out how to avoid costly mistakes before you initiate any retirement account moves.

Get “Avoiding 60-Day Rollover Mistakes in 5 Easy Steps” white paper now! Simply fill out the request form below.

For professional assistance with your IRA rollovers, contact our office at 866-589-9366 to schedule a time to discuss.